*Financial markets need better ESG data to meet increasingly complex sustainability requirements.

ESG Book is taking a new approach to make sustainability data more accessible, comparable, and transparent to support smarter decision making.

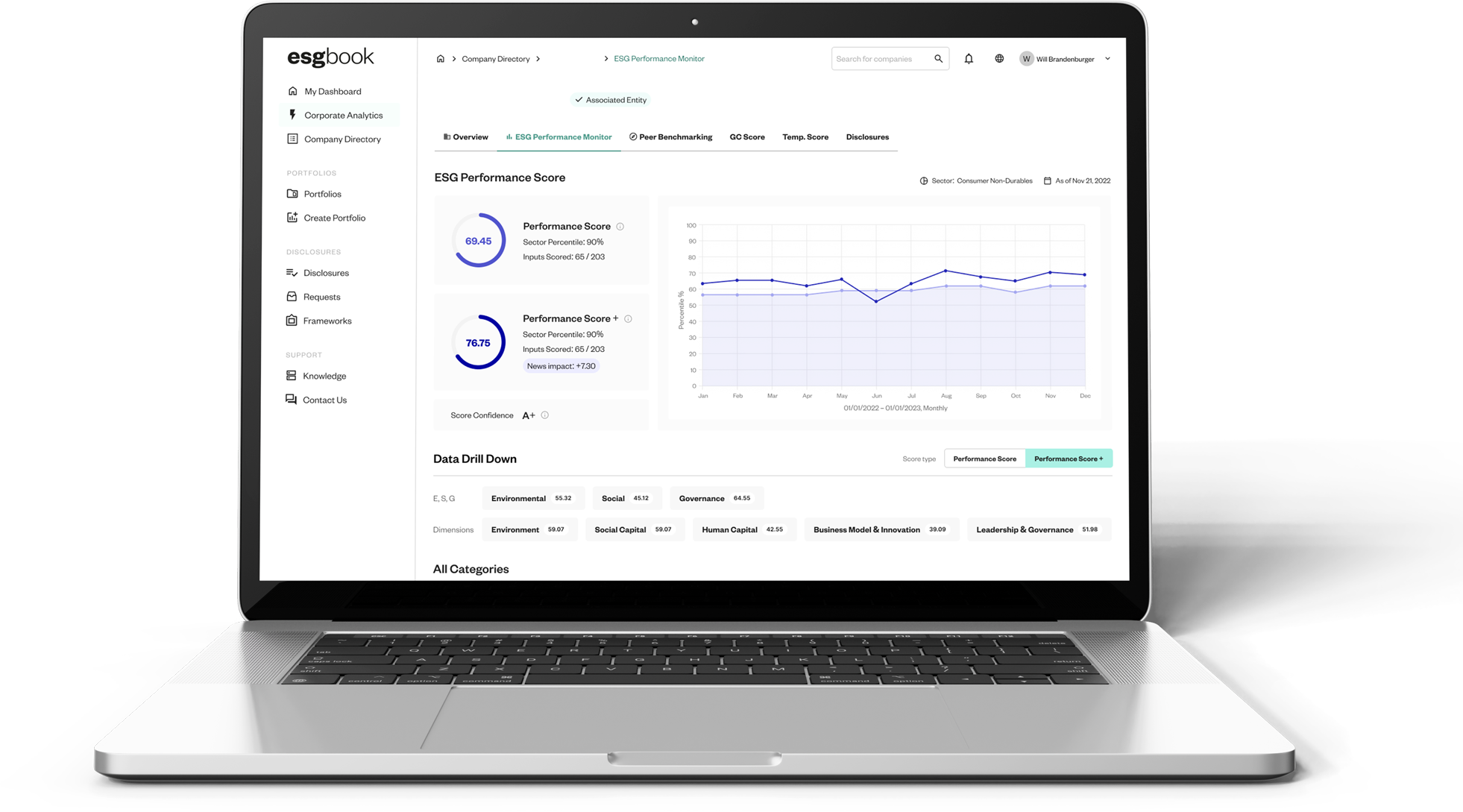

Introducing the ESG Performance Score, our transparent, data-driven assessment of corporate sustainability performance inspired by SASB’s materiality framework.

*Sustainability considerations are integral to future-oriented investment and management. However, blind spots and confusion around current scores and analytics can make integrating sustainability a challenge.

Limited insight hampers score interpretation.

Lack of standardisation and resulting divergence prompts questions of accuracy and comparability.

Opaque understanding of underlying data informing score.

Restricted ability to account for industry and sector specific metrics.

The ESG Performance Score provides comprehensive analytics on the sustainability performance of over 7,000 companies worldwide.

The ESG Performance Score offers a distinct view on point-in-time performance based on a transparent methodology.

Transparent Methodology Gain access to framework, data mapping & calculations.

Full Data Disclosure Ability to click through from scores, to raw data, to source documentation.

Established Framework Inspired by an established, evidence-based framework developed by SASB with broad market participation.

Industry & Sector Materiality Systematic industry and sector-specific weighting with insight into material areas of sustainability performance.

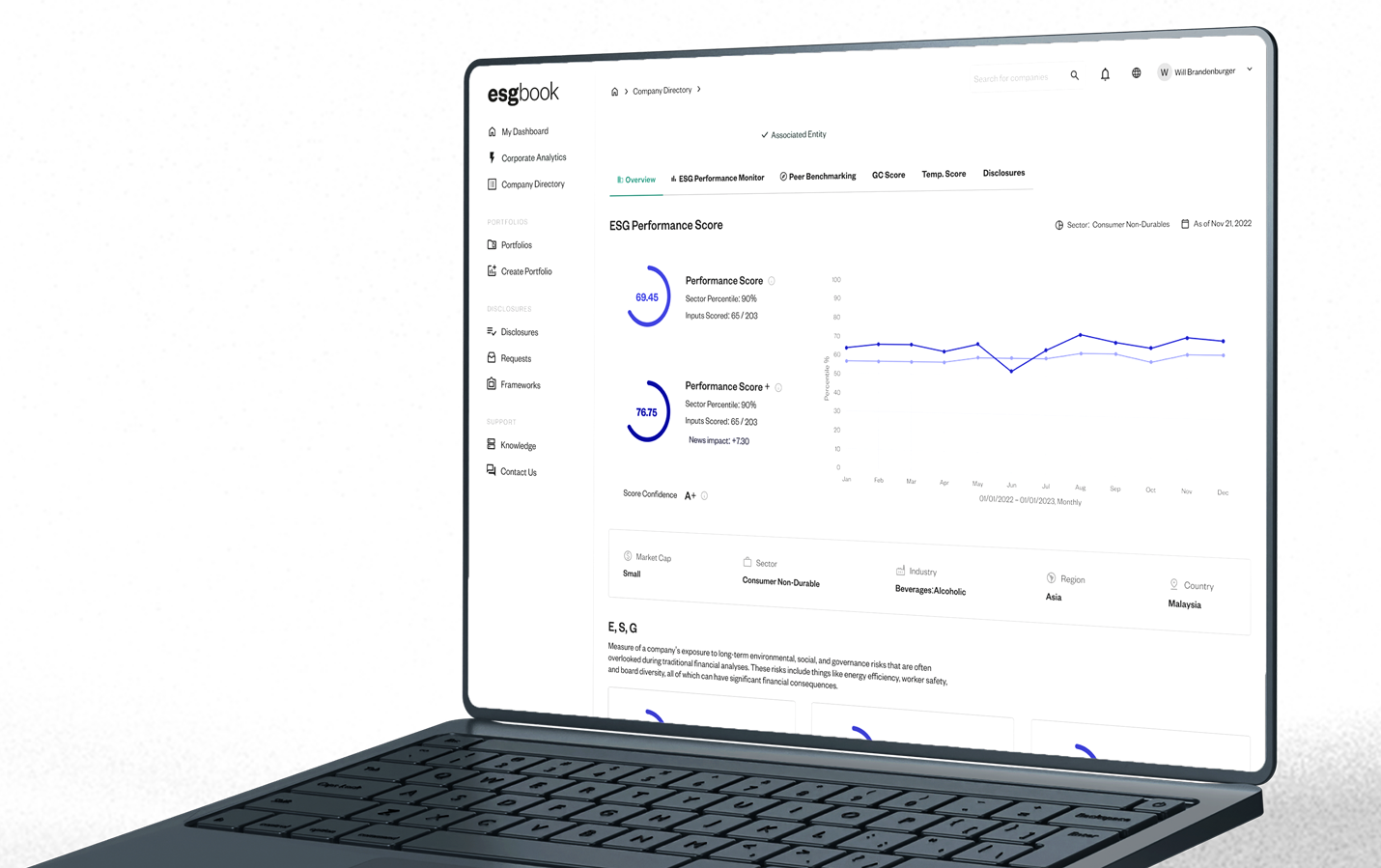

*ESG Book’s two complementary scores - ‘Core’ and ‘Plus’ - offer analytics for diverse use cases.

Point-in-time score showing companies’ sustainability performance based on publicly available company data

Media and NGO coverage corrected scores that account for the public perception of companies’ performance

The ESG Performance Score can be used for a broad range of research, investment and engagement purposes.

Reinforce internal analysis and investment decisions by helping to identify risks and opportunities based on material ESG information.

Define investable universe through portfolio exclusions and best-in-class screens based on Total, Pillar, Dimension and Category Scores as well as raw data.

Gain insight into company-level sustainability performance to enable targeted and evidence-based company engagement.

Allocate to improving ESG performance alongside returns or integrate criteria level ESG targets into other investment factors.

Deep dive into raw data disclosure in comparison to peers to identify gaps and set improvement goals.

Identify leaders and laggards within industries and sectors to understand trends and benchmark performance.

Access ESG Book Corporate Solutions directly on the platform or reach out to our team for support.

REQUEST DETAILSContact us to learn more about ESG Book’s solutions