Wealth Managers CASE STUDY // VIEW ALL

*Developing a Climate and Net Zero solution for Financial Institutions.

Wealth Managers CASE STUDY // VIEW ALL

*Developing a Climate and Net Zero solution for Financial Institutions.

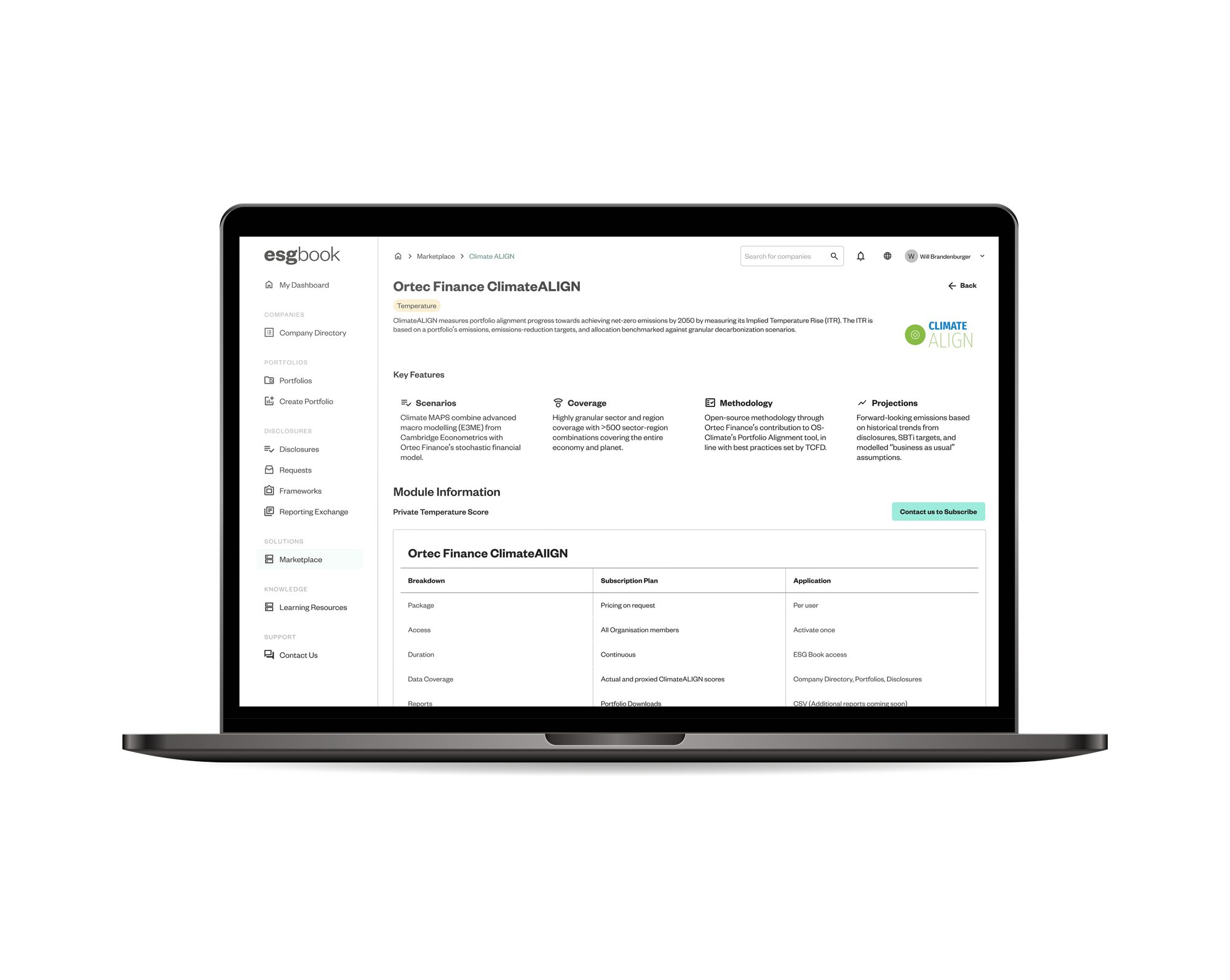

Ortec Finance, a leading provider of investment management solutions, identified ESG Book to co-develop an on-demand Implied Temperature Rise (ITR) analytics platform aimed at listed equity, corporate credit, and private assets.

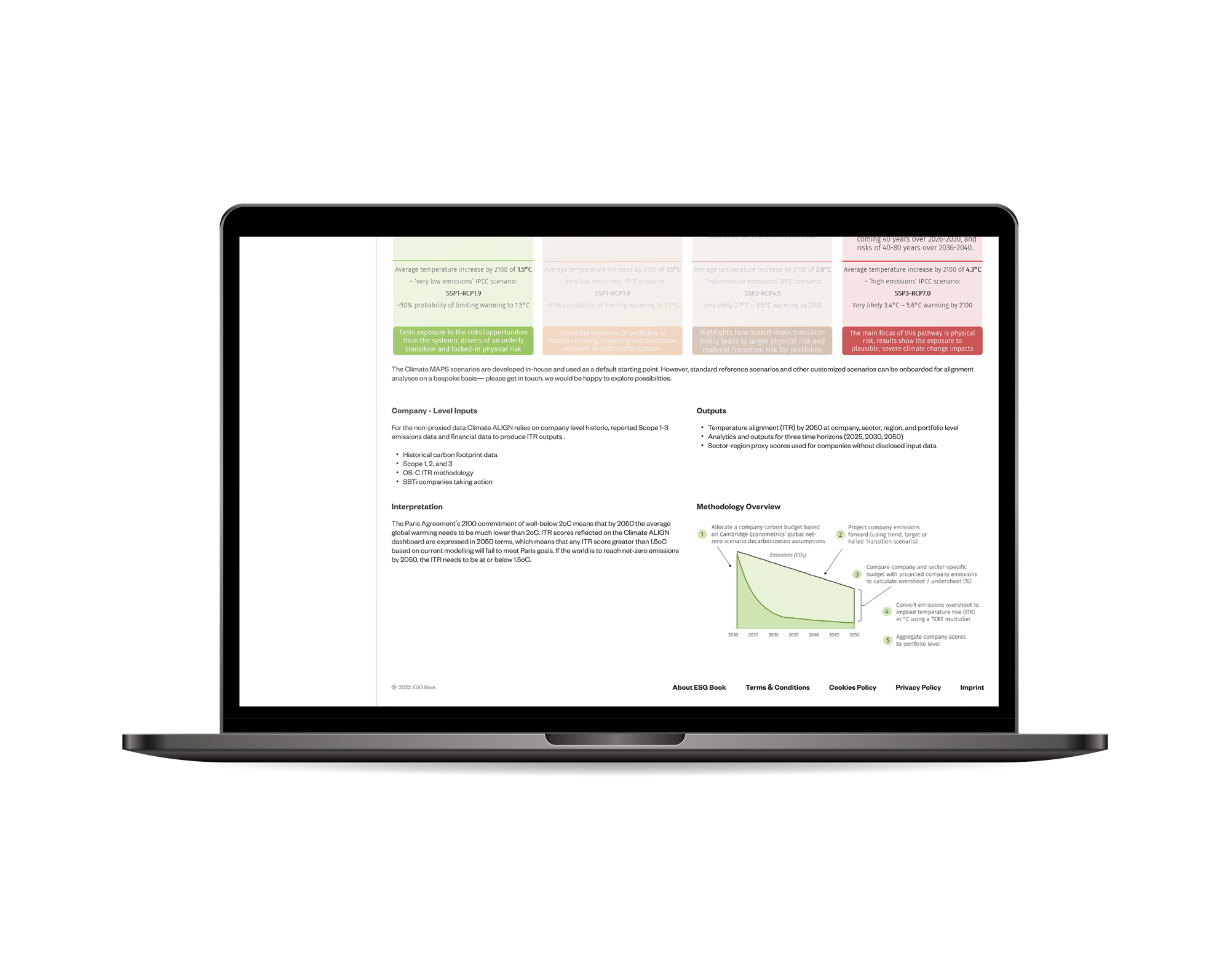

ESG Book supported Ortec Finance in developing the ClimateALIGN tool. The platform solution provides granular climate and econometric scenarios, reflecting IPCC warming scenarios and associated macro-economic pathways at a NACE sector level.

ESG Book powered Ortec’s science-based and standards-driven methodology, leveraging recommended best practices from the TCFD and OS-C

We are pleased to be able to offer financial institutions the ability to access a universal climate risk tool recognized by the United Nations Environment Programme Finance Initiative (UNEP FI) for meeting the guidance given by the Taskforce of Climate-Related Disclosure’s Portfolio Alignment Team (TCFD PAT) and Glasgow Financial Alliance for Net Zero (GFANZ).

Lisa Eichler

Managing Director Climate & ESG Solutions, Ortec Finance

Ortec Finance successfully launched ClimateALIGN in 2023, leveraging ESG Book’s best-in-class climate data with ongoing coverage increases and updates using a state-of-the-art disclosure and analytics platform

Clients can now access forward-looking emission projections based on historical trends, companies’ decarbonisation targets, and “business as usual” assumptions.