SFDR Solutions

The Sustainable Finance Disclosure Regulation (SFDR) presents requirements and data challenges to investment managers. Get ahead with ESG Book’s data and technology solutions.

REQUEST DETAILS

Helping clients align with SFDR

The Sustainable Finance Disclosure Regulation (SFDR), part of the European Commission’s Action Plan, aims to increase transparency across capital markets and set disclosure obligations for market participants on sustainability issues.

ESG Book provides clients with market-leading data and technology solutions to develop Article 8 and 9 aligned funds and investment strategies. Our solutions cover data needs across the value chain, and can be seamlessly integrated into portfolio construction, management, and reporting.

Use Cases:

Regulatory

Reporting

ESG Book covers 100% of the Mandatory SFDR PAI Metrics either through exact match or proxy data points.

SFDR Classification:

Art.

8 and 9

Create unique Article 8 and Article 9 aligned strategies with our raw data offerings.

PAI reporting and

monitoring

Utilise our PAI calculations and raw data metrics for an effective and compliance-proof PAI risk monitoring strategy.

Disclosure

Requests

Automate data disclosure requests for portfolio companies where data is missing or unavailable, directly via ESG Book.

SFDR

Raw Data Module

SFDR raw data metrics that easily be integrated into client systems, allowing full customisation and flexibility.

ESG Book’s SFDR Raw Data Module is based on a mapping of ESG Book’s proprietary suite of raw data metrics to the 47 SFDR corporate-level Principal Adverse Impact (PAI) indicators.

ESG Book covers 100% of the Mandatory SFDR PAI Metrics either through exact match or proxy data points.

Coverage of

Principal Adverse Impact Indicators (PAIs)

ESG Book covers 100% of the Mandatory SFDR PAI Metrics either through exact match or proxy data points.

| Adverse Sustainability Indicator | SFDR Key | ESG Book Coverage |

| 1. GHG emissions (Scope 1) | SFDR_M.1.1 | Match |

| 1. GHG emissions (Scope 2) | SFDR_M.1.2 | Match |

| 1. GHG emissions (Scope 3) | SFDR_M.1.3 | Match |

| 1. GHG emissions (Total) | SFDR_M.1.4 | Match |

| 2. Carbon footprint | SFDR_M.2 | Match |

| 3. GHG intensity of investee companies | SFDR_M.3 | Match |

| 4. Exposure to companies active in the fossil fuel sector | SFDR_M.4 | Proxy |

| 5. Share of non-renewable energy consumption and production | SFDR_M.5 | Match |

| 6. Energy consumption intensity per high impact climate sector | SFDR_M.6 | Match |

| 7. Activities negatively affecting biodiversity-sensitive areas | SFDR_M.7 | Proxy |

| 8. Emissions to water | SFDR_M.8 | Match |

| 9. Hazardous waste ratio | SFDR_M.9 | Match |

| 10. Violations of UN Global Compact principles and Organisation for Economic Cooperation and Development (OECD) Guidelines for Multinational Enterprises | SFDR_M.10 | Proxy |

| 11. Lack of processes and compliance mechanisms to monitor compliance with UN Global Compact principles and OECD Guidelines for Multinational Enterprises | SFDR_M.11 | Proxy |

| 12. Unadjusted gender pay gap | SFDR_M.12 | Proxy |

| 13. Board gender diversity | SFDR_M.13 | Match |

| 14. Exposure to controversial weapons (anti- personnel mines, cluster munitions, chemical weapons and biological weapons) | SFDR_M.14 | Proxy |

| Adverse Sustainability Indicator | SFDR Key | ESG Book Coverage |

| 1. Investments in companies without workplace accident prevention policies | SFDR_O.17 | Match |

| 2. Rate of accidents | SFDR_O.18 | Match |

| 3. Number of days lost to injuries, accidents, fatalities or illness | SFDR_O.19 | Match |

| 4. Lack of a supplier code of conduct | SFDR_O.20 | Match |

| 5. Lack of grievance/ complaints handling mechanism related to employee matters | SFDR_O.21 | Proxy |

| 6. Insufficient whistleblower protection | SFDR_O.22 | Match |

| 7. Incidents of discrimination | SFDR_O.23.1 | Proxy |

| 7. Incidents of discrimination | SFDR_O.23.2 | Proxy |

| 8. Excessive CEO pay ratio | SFDR_O.24 | Proxy |

| 9. Lack of a human rights policy | SFDR_O.25 | Match |

| 10. Lack of due diligence | SFDR_O.26 | Proxy |

| 11. Lack of processes and measures for preventing trafficking in human beings | SFDR_O.27 | Proxy |

| 12. Operations and suppliers at significant risk of incidents of child labour | SFDR_O.28 | Proxy |

| 13. Operations and suppliers at significant risk of incidents of forced or compulsory labour | SFDR_O.29 | Proxy |

| 14. Number of identified cases of severe human rights issues and incidents | SFDR_O.30 | Proxy |

| 15. Lack of anti-corruption and anti-bribery policies | SFDR_O.31 | Match |

| 16. Cases of insufficient action taken to address breaches of standards of anti-corruption and anti- bribery | SFDR_O.32 | Match |

| 17. Number of convictions and amount of fines for violation of anti-corruption and anti-bribery laws | SFDR_O.33 | No Match |

Granularity

SFDR raw data metrics that easily be integrated into client systems, allowing full customisation and flexibility.

ESG Book’s SFDR Raw Data Module is based on a mapping of ESG Book’s proprietary suite of raw data metrics to the 47 SFDR corporate-level Principal Adverse Impact (PAI) indicators.

Complete coverage

100% coverage of the mandatory metrics and 80% of the Opt-in metrics.

PAI calculations

PAI score-level calculation methodologies constructed by our in-house regulatory solutions research team.

SFDR Disclosure

Solution

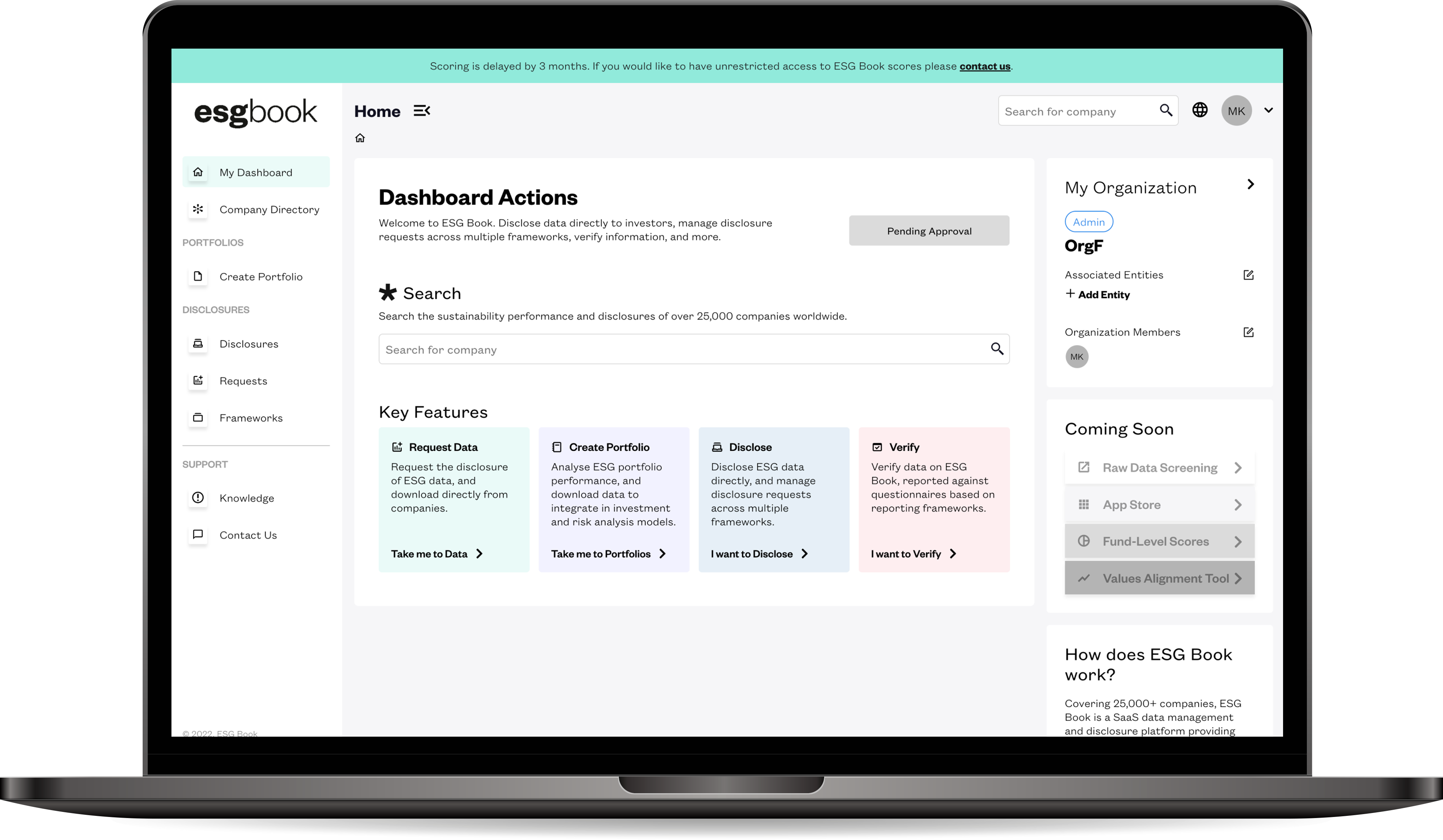

ESG Book provides corporates with a streamlined solution for efficient SFDR data disclosure. Our market-leading platform enables investors to identify and fill SFDR data gaps by directly engaging with portfolio companies and requesting them to report.

SIGN UP TO ESG BOOK

Key Features

Request and Disclose ESG Data

Facilitate the request and disclosure of ESG data and actionable ESG information via our automated one-stop platform disclosure features.

Apps

Build or subscribe to apps that transform ESG data into actionable use cases.

Manage Requests

Manage and map disclosure requests and answers across multiple frameworks, prioritising requests and selecting data points to report based on materiality.

Find out more

Contact our team to discuss how ESG Book can help with your SFDR compliance journey.

REQUEST DETAILSContact Us

Contact us to learn more about ESG Book’s solutions